Top Suggestions For Picking Fx Trading Sites

Wiki Article

Top 10 Market Knowledge And Strategy Tips For Those Who Are Considering Trading Forex Online

The process of trading Forex online can be an uphill task, but having the right understanding of the market and a plan of action you can minimize your risk and increase your chances for success. These are the 10 most important things to consider when trading Forex on-line: 1.

Understand Economic Indicators

Economic indicators (like GDP rates, employment statistics, and inflation data) are indicators that show the state of health of a particular country, are vital for Forex. For instance, strong employment statistics from the U.S. usually strengthen the USD. Stay informed by keeping up on the schedule of economic developments.

2. Focus on Risk Management

The management of risk should be a priority from the start. Establish stop-loss and take-profit amounts to protect your investment and avoid excessive losses. A lot of experienced traders advise just putting in a small percentage of your trading account (e.g. between 1-2%) for each trade.

3. Make Use of Leverage Carefully

It is important to use leverage wisely. It's best to begin by utilizing a lower leverage until you understand the way leverage impacts your position. In excess, leverage can cause massive losses.

4. Plan your trading strategy

A good trading plan can help you remain disciplined. Define your trading goals including the entry and exit points and risk tolerance. Create your trading strategy. This involves determining whether you're using technical or fundamental analysis.

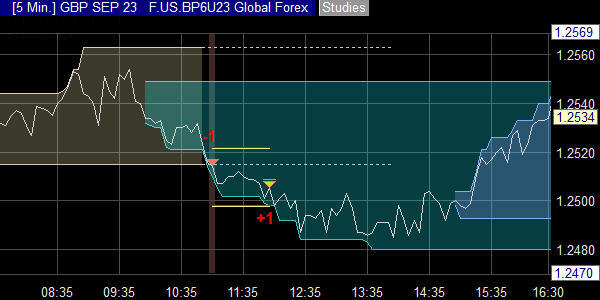

5. Master Technical Analysis Fundamentals

Knowing the technical aspects of Forex trading is important. Learn about candlesticks, moving averaging and trend lines. These tools can assist you in identifying potential trade opportunities and manage entry/exit points effectively.

6. Global News Updated Stay informed

The currency market can be impacted by natural disasters or political events, as well as international trade agreements, and central bank policies. For instance, an unanticipated interest rate reduction by a bank may reduce the value of its currency. Staying on top of world news can help you to anticipate potential changes in the market.

7. Select the right currency pair

Certain currency pairs, including EUR/USD, GBP/USD, and USD/JPY, are stable and have greater liquidity, making them a good choice for those who are new to the market. Foreign currency pairs, while they can sometimes provide high returns, are usually more unpredictable and more risky. Knowing the characteristics of each currency pair can help you select the one that is suitable for your trading style.

8. Demo account is the first.

Demo accounts are a fantastic opportunity to understand the platform and devise strategies prior to trading in actual time. This helps you build confidence and test your trading plan in a secure, risk-free environment.

9. Monitor interest rates and central bank policies

Rates of interest and monetary policy play a major role in the currency valuation of central banks. A higher interest rate can draw foreign capital, which can strengthen the currency, whereas low rates can make it weaker. The Federal Reserve, European Central Bank and other central banks take decisions which can have a major impact on the currency's movements.

10. Keep an Journal of Your Trades

A thorough journal of your trading activities will allow you to improve your discipline, and it will also highlight your strengths and weaknesses. Record all transactions, including reasons behind trading entries and exits, the times of entry and departure, and results. Reviewing your data regularly can reveal patterns of your trading behavior, and refine your strategy over time.

In the end, success in Forex trading relies on thorough understanding of markets as well as strategic planning and a disciplined execution. Stay informed, monitor your risk, adapt your strategy when the market changes. Follow the top rated https://th.roboforex.com/ for more tips including fbs review, united states forex brokers, best currency brokers, best forex broker trading platform, best forex trading broker, best forex trading platform, forex exchange platform, forex brokers list, forex exchange platform, best broker for currency trading and more.

Top 10 Tips For Understanding And Using Leverage When Trading Online For Forex

These are the top 10 tips for understanding and using leverage effectively:1. Here are 10 top tips to help you understand and use leverage effectively:1.

1. Leverage: Basics and Concepts

Leverage is a way to manage an investment that is greater than your capital. A leverage ratio of 1:100, for instance is a way to take control of 100 dollars on the market with every dollar you have. However, any change in the market could affect your account through the same amount. Therefore, both gains and loss could be boosted.

2. Be aware of the risks associated with high Leverage

A higher leverage level can increase both profits and loss. With leverages of 1 to 500, even a 0.2 percent decline in value can wipe out the total investment. Beginning traders might be enticed to make use of high leverage, but it is important to remember that this could lead to huge losses if markets are not in their favor.

3. Start with Low-Leverage

If you're new to Forex trading, it is recommended to begin with the leverage ratio of 1:10 or 1:20-especially if this is your first time. This will allow you to manage your risk of losses and help you gain confidence and experience without taking a huge risk with your money.

4. Calculate the Margin You Need

In order to leverage a position, you'll have to have a specific amount in your account. If you have a leverage ratio of 1:100 ratio, then a $10,000 trade will only require a margin of $100. You need to be aware of these guidelines in order to avoid being liquidated or having your account canceled.

5. Use Leverage in Line with Your Trading Strategy

Short-term, high-frequency trading might gain from moderate leverage thanks to the tight stop-loss positions. In contrast, long-term trading might benefit from less leverage since these trades are held for longer periods of time and more significant price swings. Customize leverage based on the goals and timeframe of every trade.

6. Set Strict Loss Stop Orders to Every Trade

Stop-loss limits your loss if you are in a leveraged situation. This protects your capital in the event that the market moves to the downside. Since leverage increases losses, make sure you set your stop-loss at a level that is in line with your tolerance for risk. This prevents the losses from escalating.

7. Monitor Your Leverage Ratio Regularly

Check your positions regularly to ensure you're not over-leveraged. Leverage ratios can be kept by reducing or putting a stop to certain trades.

8. Make use of a Margin Calculator as well as a Leverage Tool

A lot of brokers provide margin calculators, or tools to help you determine the amount of leverage you're utilizing and the margin you need to trade. These tools will assist you to better understand the dangers and ways to be careful not to use excessive leverage.

9. Be aware of restrictions on leverage by Region

Different regions set their own limits for leverage, based on regulatory guidelines. For example in the U.S., retail traders are limited to a 1:50 leverage ratio. In the EU, leverage on the major currencies is capped at 11:30. In order to ensure compliance and limit risk, choose a leverage ratio that is within legally-required limitations.

10. Re-evaluate the Leverage option based on the current market conditions

Market conditions can shift rapidly which can impact the potential risk of leveraged trades. In times of volatility or when there is a release that has an impact that is significant on the market, you might want to lower your leverage. When times are uncertain, lowering leverage can assist in preventing sharp and unexpected price movements.

Conclusion: When evaluating leverage, it is crucial to be aware of both the benefits and dangers. When you use leverage in a responsible manner by setting up protective stop-loss orders, and choosing the right leverage ratio you will reap the benefits while minimizing the dangers. Read the best https://th.roboforex.com/partner-program/ for blog recommendations including fx trading forex, forex trading strategies, foreign exchange trading online, good forex trading platforms, 4x trading, trader fx, broker cfd, top forex trading apps, forex broker, fx online trading and more.

Top 10 Tips For Achieving Your Personal And Financial Goals When Trading Forex Online

Forex trading is only successful only if you've clearly defined financial and personal goals. Well-defined goals help keep your trading focused, disciplined, and aligned with your financial goals overall. Here are the 10 best strategies for achieving your financial and personal goals when trading online Forex.

1. Define Your Financial Objectives Clearly

Create specific financial goals, such an income target or annual return target. Choose whether you are aiming for an increase in capital value, additional income, or wealth preservation. Knowing your goals will help you select strategies that align with desired outcomes.

2. Create a Realistic Timeframe

Training, learning and growing in the field of forex trading is a process that takes time. Set short, medium and long-term goals to track your progress and prevent unreasonable expectations. For example, your short-term objective could be to develop an effective trading strategy that is profitable, while your long-term goal may be to produce consistent monthly returns.

3. Determine Your Risk Tolerance

Assess your risk tolerance and align your goals with it. You must be ready to take on greater risk, as well as potential losses when your objective is to earn high returns. Knowing your risk tolerance can help you establish goals and choose strategies within your comfort range.

4. Plan a Capital Allocation Strategy

Choose the amount you wish to invest of your overall budget to Forex trading. Make sure your investment in trading capital is a sum you can afford to lose without affecting your financial stability. You can then ensure that your trading won't affect the funds you need for bills, saving or any other obligations you have for yourself.

5. Priority is given to the development of skills

Focus not solely on the return you earn from your financial investments. Instead, you should strive to continuously improve your knowledge and trading skills. You can set up skill growth goals like learning certain strategies for trading and improving your risk management abilities, or learning how to control emotions when under pressure. Skills improve as time passes and result in better results.

6. Prioritize Consistency Over Large Wins

Many beginners aim for big profits in a short time, but experts know that steady, steady gains are more sustainable. Set monthly goals that will lead to a realistic gain in percentage. Focusing on steady returns will help you avoid risky behaviors and build a more stable record.

7. You must commit to tracking and evaluating your own performance

As a goal, keep a trade journal where you record all trades and analyze their results. Retrospective on the lessons you've learned. Monitoring your performance on a monthly basis or quarterly allows you to adjust your strategies, stay accountable to your goals, and help you refine your approach.

8. Set Psychological and Behavioral Goals

Trading requires discipline in the mind and emotional control. Set psychological goals, like minimizing impulsive transactions, sticking to the plan for trading, and limiting your desire to revenge trade. These goals will assist you in developing a positive attitude and more focused approach.

9. It is not a good idea.

Comparing your trading results with other traders can create unnecessary stress and lead to dangerous choices. Set your goals according to your personal progress, financial capacity, and not the outcomes achieved by other traders. Concentrate on improving your performance gradually rather than trying to compete with others.

10. Determine your exit strategy and financial timeframe

Set a goal to either stop trading, withdraw your profits, or evaluate your improvement. For example, once you reach a certain income milestone, take a portion of the profits to enjoy or put them into a new investment. By setting an "take profit" date, you will be able to avoid overtrading while also appreciating your achievements.

Set and manage clearly-defined financial and personal trading goals can assist you in improving your discipline and lessen stress. They can also assist you towards achieving sustainable success. As you grow, modify your objectives to reflect constant improvement, consistency and accountability for yourself. Have a look at the top rated https://th.roboforex.com/beginners/info/national-holidays/ for more advice including top forex trading apps, forex app trading, foreign exchange trading online, fx forex trading, forex exchange platform, best currency brokers, forex trading brokers, forex market online, currency trading demo account, forex broker platform and more.